Large, private higher education institution

Case Study: Strategy

Client facing increased costs and low employee satisfaction with dual plan options (Preferred Provider Organization (PPO) & Health Savings Account (HSA) eligible High Deductible Health Plan (HDHP)), due to large (50 year) spread in age of workforce.

How We Helped

Implementation of a private exchange with defined contribution approach, where all employees were offered a set contribution to spend in the private exchange and expanding from two plan offerings to six (three PPO & three HSA-eligible HDHPs) to give greater choice to workforce.

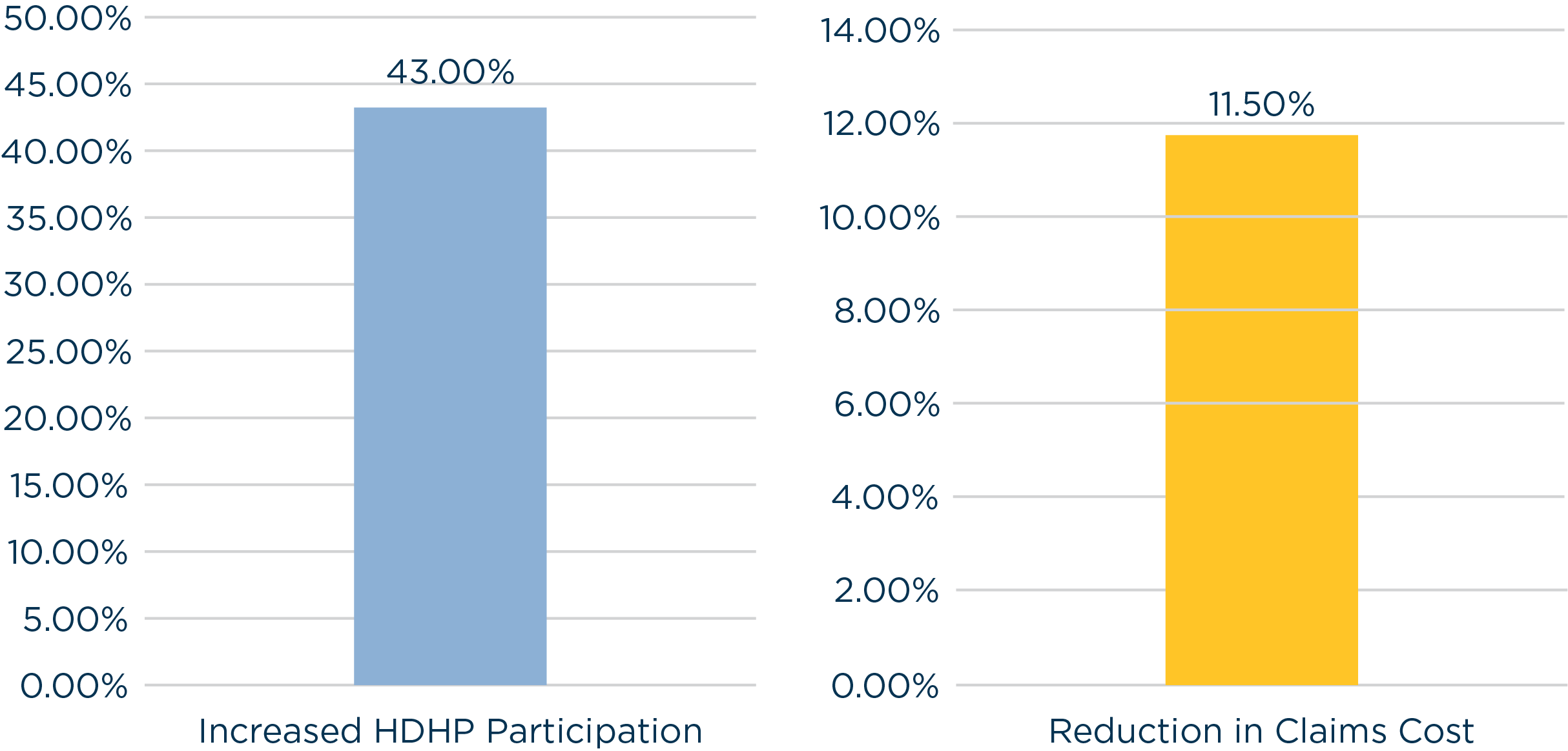

Resulted in increased HDHP participation by 43% and employees chose plans with higher deductibles and out of pocket limits resulting in a 11.5% lower claims cost.

Further, managed loss of grandfathered status with religious doctrines and implemented Temporary Enforcement Safe Harbor (TESH) for birth control coverage to be compliant with the Affordable Care Act.

A private exchange, also known as a private benefits exchange or private health care exchange, is an online store or health insurance marketplace where employees purchase health insurance and other benefits, typically using funds contributed by their employer.